April is Financial Literacy Month, and we’re commemorating the occasion with a series of blog posts from DEC members about economic security and financial resources for our elders. Today’s blog post originally appeared on the NICOA blog.

by Christine Herman

Making good financial decisions isn’t easy. Despite the fact that we gain knowledge over the course of our lives, as Elders it actually becomes more difficult to make sound financial choices. As part of the aging process some may experience a decline in decision-making ability. Cognitive impairment and conditions like dementia or Alzheimer’s disease can accelerate the decline of decision-making ability.

But it’s not just our ability to understand financial situations that makes it difficult. The world is increasingly complex, with many different costs and expenses to keep track of each month. It is also more complicated, as financial services have become more and more difficult to understand – and some of them are downright dangerous.

Tight budgets and thin paychecks have caused many of us – Elders and our children alike – to find it hard to make ends meet. Loans which didn’t exist 50 years ago – payday loans, car title loans, tax refund loans, and other types of loans, have crept into our communities. These loans are what are called “predatory loans” because the companies that make them only care about their own profits – often at the expense of American Indians and Alaska Natives (AI/AN). Unfortunately, research suggests that in some parts of Indian Country, as many as 50% of all AI/AN have used predatory loans.

Though many nations have tried to put a stop to these loans, they’re often still legal outside of tribal jurisdiction and just a short drive from our communities. The results are often tragic – people spend thousands upon thousands of dollars struggling to get out of debt, often because of a loan that was only a few hundred dollars. Some AI/AN have gone without food, and others have lost their cars or even their homes as a result of these predators and their loans.

While finances can be complicated, creating a basic budget to understand where one’s money is going every month – and how much is coming in – is crucial for our wellbeing. It is also important to learn how to identify and avoid bad loans and financial services that are designed to hurt us and make others rich. So too is knowing what services and benefits are available to help make ends meet – and there are some good resources available to help make financial decisions a little easier.

Making decisions about money can be challenging. So much so, that we may put off making decisions until another day. But the financial decisions you make (or don’t make) through the course of your life can have far-reaching effects as you age. For Elders on a tight budget, the financial decisions you make today are very important and can have a dramatic impact on your current standard of living, as well as what you may be able to leave your children or heirs in the future.

Financial decision-making may not get easier with age

Evidence suggests that even though we gain experience making financial decisions as we age, unfortunately our cognitive ability – the ability to think a problem through – decreases after age 53. (1) This means that making good decisions when it comes to managing money, investments, and debts gets more difficult for Elders as they age.

Elders with “mild cognitive impairment” – those who have some difficulty with memory – will experience much more difficulty making good financial decisions. This is a part of the aging process, as the ability to easily and quickly learn new information begins to decrease in ones 60’s, and more rapidly decreases in ones 70’s. Elders with diagnosed dementia or Alzheimer’s disease will experience a more rapid decline in their ability to make financial decisions.(2) In 2010, American Elders lost $2.9 billion dollars due to financial abuse such as fraud and scams. (1)

Threats to Financial Safety

Threats to Financial Safety

There are a growing number of threats to financial safety. The age of the Internet has brought new threats, with hackers – computer criminals – and “viruses” – bad computer programs – that are able to steal financial information by using fraudulent emails or websites. In addition, high interest loans or financial services that take advantage of the need for quick cash can be very expensive and can wreck your financial future.

Loan services are a major problem around AI/AN communities. While many nations in Indian Country have passed laws to limit or outlaw services such as payday loans, title loans, or tax refund loans, these services do still legally operate outside of tribal lands in many states. The companies providing these types of loans are often referred to as “predatory lenders” because the loans come with very high interest rates – the price paid for the money borrowed – and other fees that can make the loan difficult or impossible to repay. (3)

In many communities, there may be little or no access to banking services and even those living near a bank may find it difficult to get a personal loan. Because of disparities in income and little or no access to banks and credit, AI/AN communities are by far the largest population using predatory loans. Where only about 6% of the general population in the United States has utilized these types of loans, research has shown that nearly half of American Indians on New Mexico and South Dakota reservations have used them before. (3)

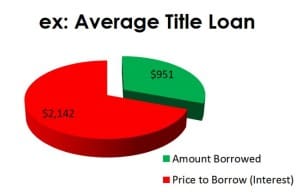

For example, a title loan – a predatory loan against the ownership of a car – has an interest rate of 300% and only pays a loan amount of 26% of the vehicle’s value on average. The average title loan recipient will receive a loan of $951 but will have to pay $2,142 in interest in addition to the loan amount. The total to repay the loan, on average, is $3093. (4)

In other words, the average total price for every $1.00 borrowed is $2.26, and the repayment for every dollar borrowed is $3.26. Those who cannot repay the loan will lose their vehicle, may be charged fees and may still be required to repay part of or the entire loan.

While payday, installment, or tax refund loans may not carry the risk of the loss of a vehicle, they too carry very high interest rates and fees that make repayment extremely expensive. All such predatory loans are designed to help the company that issues the loan make a hefty profit, regardless of the consequences to the borrower. Especially for Elders on a “fixed income” of Social Security and/or retirement benefits, such loans can be devastating whether or not they result in the loss of property.

Half of all states have laws to outlaw predatory lending, but unfortunately predatory loans may still exist. Some companies within Indian Country operate on nations where predatory lending is still not illegal, and may offer large loans with repayment over many years. These loans have the same characteristics of the smaller predatory loans, and may cost eight times as much as the loan amount to repay. (5) Extreme caution should be used when looking for a loan whether or not the source of the loan is inside or outside Indian Country.

Other threats to your financial security may include scam artists or other fraudulent activities. Watch out for and avoid unsolicited mail, email or messages demanding that you verify bank account or other personal information. Never open email from unfamiliar senders. Always do business with companies and individuals that you are familiar with to avoid the possibility of being scammed. If it is “too good to be true,” it probably is! (1)

Making Good Financial Decisions

Financial decisions are often complicated and can be confusing. However, a number of different resources are available to help make understanding and dealing with financial issues easier. The resources below can help you create a better financial plan.

Online calculators

The online calculator found on the American Association of Retired Persons (AARP) website (https://secure.aarp.org/work/retirement-planning/retirement_calculator.html), and can help determine how much money you need to retire based on a wide variety of financial factors.

A Retirement Estimator, tool found on the Social Security Administration website (https://www.socialsecurity.gov/retire/estimator.html is a resource to help you more accurately plan for retirement by helping determine how much your social security benefit will be.

And finally, the online calculator found on Credit Karma’s website (https://www.creditkarma.com/calculators/debtrepayment) can help you determine how long it will take to pay back a loan or credit card based on the amount borrowed, the interest rate, and either how much you can pay per month or how soon you want to repay the debt.

Create a monthly budget

Especially for Elders on a fixed income, it is critical to have a clear picture of all the monthly expenses and income in the household. Gather all of the monthly bills (known as ‘fixed expenses” – the same every month), social security statements, pension and/or retirement income statements, as well as receipts for things like groceries and fuel (known as ‘variable expenses’ because they can change month to month).

Download the easy NICOA basic budget tool (requires Microsoft Excel) or create a simple document listing the following to get an idea of how much is spent every month and how much income is available to cover expenses:

- Fixed Expenses: mortgage/rent payment; home owner/renter insurance; health insurance/Medicare; life insurance; car payment; car insurance; phone bill; cable/satellite bill; internet bill; other loans payments,

- Subtotal (add all fixed expenses): $

- Variable Expenses: electricity bill; natural gas/propane/heating oil bill; water bill; gasoline or diesel expenses; credit card payments; food and household goods expenses; prescription costs; other purchases (like appliances, clothes, copays, etc):

- Subtotal (add all variable expenses): $

- TOTAL EXPENSES (add fixed and variable expenses): $

- Income: social security benefits; retirement/investment income; pension income; salary from work; other sources of income:

- TOTAL INCOME (add all income): $

- NET INCOME (subtract expenses from income): $

If net income is a positive number (like $250), this is the money left over after all monthly bills and expenses are paid. If net income is a negative number (like -$135), the expenses are more than monthly income and cannot be paid without taking on debt (like loans, credit cards, etc.), reducing expenses (like cancelling cable or internet service), or attaining more income or financial assistance (like a new job or SNAP benefits).

Start saving money – it’s not too late

Start saving money every month. Saving $25 per week, every week for ten years in an account that paid no interest would amount to $13,000! Many credit unions and banks offer free savings accounts which pay interest (pay you money). Other credit unions and some banks offer a free checking account if certain conditions are met, like having a monthly direct deposit (such as a Social Security check or paycheck) put directly into the account.

You can choose to have a certain amount of money automatically moved from checking to savings each month, a secure way to put money away for retirement without even having to think about it. Check with your local credit union or bank for details about different accounts that are available and ask about free savings and checking account services. Starting to save early and saving as much as possible will help ensure a secure financial future.

Never use predatory loans!

Loan companies specializing in predatory loans are there to make money for themselves at the expense of the borrower. Predatory lenders do not care what happens to the borrower, whether it’s paying thousands of dollars in interest, going hungry, or even losing a car or home due to an inability to pay monthly expenses.

NEVER sign without reading the “fine print”

Contracts and agreements to buy products or services, for loans, or for other legal or financial matters are VERY important. The conditions for buying the product or service are found in these documents – often in the “fine print” – specify the terms that are being agreed to and may be legally binding. Even though the documents are usually lengthy and may contain complicated legal language, always read them before signing anything. Make sure that the terms and conditions are clear and understandable.

If the document does not make sense or is too hard to understand, request a copy of the contract and seek the advice of someone who is knowledgeable and qualified to explain it. NEVER sign anything that does not make sense or is too hard to understand without getting help first. It is easy to walk away from a bad deal before any documents are signed, but after a contract is signed, it can be very hard to get out of one. Do not give into the pressure of someone trying to make a deal; it’s always okay to walk away and come back later.

Get Help: Counseling & Benefits

Aging and Disability Resource Centers (ADRC) can provide options counseling services and connections to resources that can assist with financial planning. These centers can also help Elders get benefits, such as help to pay for food, electricity and heat, phone services, medical costs, prescriptions, and much more.

The U.S. Department of Health and Human Services, Administration for Community Living provides an interactive map to help locate an ADRC near you (http://www.adrc-tae.acl.gov/tiki-index.php?page_ref_id=739), as well as a complete directory of ADRCs in the U.S. and U.S. territories.

The opinions expressed in this article are those of the author and do not necessarily reflect those of the Diverse Elders Coalition.

SOURCES:

- Setzfand, Jean C. (2011). Give Your Parents the Gift of Financial Peace of Mind. Retrieved November 2015, from AARP:http://www.aarp.org/money/investing/info-10-2011/financial-help-for-elderly-parents.html

- Eisenberg, Richard (2013). How Aging Impacts Our Financial Decisions. Retrieved November 2015, from Next Avenue;http://www.nextavenue.org/how-aging-impacts-our-financial-decisions/

- Wessler, Seth Freed (2014). Endless Debt: Native Americans Plagued High-Interest Loans. Retrieved November 2015, from NBC News; http://www.nbcnews.com/feature/in-plain-sight/endless-debt-native-americans-plagued-high-interest-loans-n236706

- Giusti, Autumn Cafiero (2013). The Consumer Perils of a Car Title Loan. Retrieved November 2015, from Bankrate:http://www.bankrate.com/finance/auto/consumer-perils-car-title-loan.aspx

- Pilnick, Katherine (2013). Regulations Target Western Sky and Native American Predatory Lending. Retrieved November 2015, from Debt. Org: https://www.debt.org/2013/02/25/western-sky-predatory-lending/