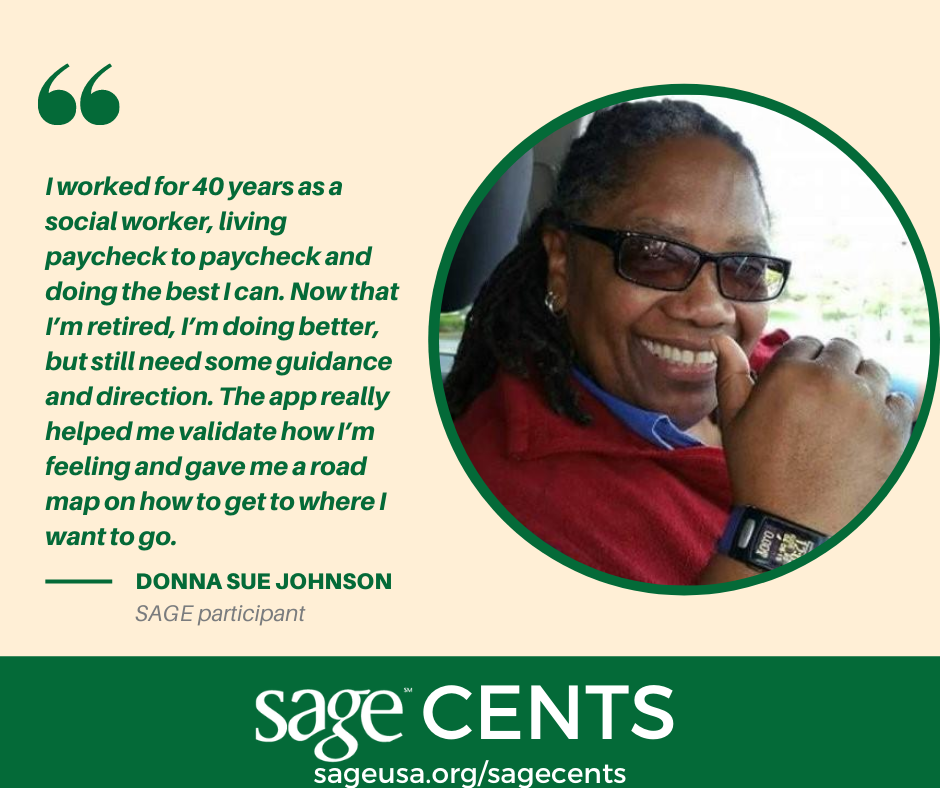

By Donna Sue Johnson, SAGE Participant. This article originally appeared on the SAGE blog

The SAGE community has always been a supportive and uplifting place for my partner and me. I find that it’s easy for elders to fall between the cracks, and as a social worker, it’s important to me that we do all we can to make sure no one gets lost. That’s where SAGE comes in.

As a Black lesbian, it’s always been a struggle to deal with the misogyny, racism, and homophobia that is embedded in our world. While these obstacles have continued to cause challenges for those of us, I like to call OWLs – older wise lesbians – I never thought they would affect my finances. But since I signed up for SAGECents, the new financial wellness app launched by SAGE and LifeCents, I’ve been learning about how my experiences as a member of the LGBT community have influenced my financial journey.

As I navigated my career in social work, my job was always my main focus. I worked three jobs while also going to graduate school, so I was not thinking about saving money or owning a home. I was more concerned with making sure I had my rent paid, as well as my car payment covered, because that was my means to get to work. I only thought about budgeting in terms of making sure I had what I needed to succeed in the moment, but not necessarily in the long run.

LGBT elders have dealt with discrimination for decades, forcing us to build up a wall that prohibits our freedom to dream bigger. We couldn’t think about our financial future, because we were so busy managing our stress and survival day-by-day. Now that I’m retired, and I have a partner who I love, I want to utilize all of the knowledge that I’m gaining through SAGECents to improve our living situation.

Some of the curricula may seem elementary to folks, but the truth is, you never know what page someone is on in terms of their financial goals. We all need that basic knowledge first, and then we can move on to a more individualized plan. That necessary foundation is what SAGECents provides.

There are still challenges, but as I continue to learn more about financial independence, freedom, and security, I truly believe that it’s better late than never. I don’t want anyone to feel that they’re being admonished about how they spent their money over the years. SAGECents is a helpful tool that proves that there are always opportunities to improve your financial journey.

In the field of social work, the best thing you can do is connect people with resources, which is precisely what SAGECents is all about. It is an invaluable resource that connects people with useful information and tools that can help them reach their unlimited potential. That’s the main thing I want people to take from this opportunity: it doesn’t matter how old you are – you can still reach your unlimited potential, and that includes improving your financial wellness.

Join me in signing up for SAGECents today at sageusa.org/sage-cents to access key resources that can help strengthen your financial literacy and resiliency. Because it’s never too late to regroup, make improvements, and move forward.

The opinions expressed in this article are those of the author and do not necessarily reflect those of the Diverse Elders Coalition.